Furniture Any furniture fittings including electrical fittings and air conditioners. Written down the value on.

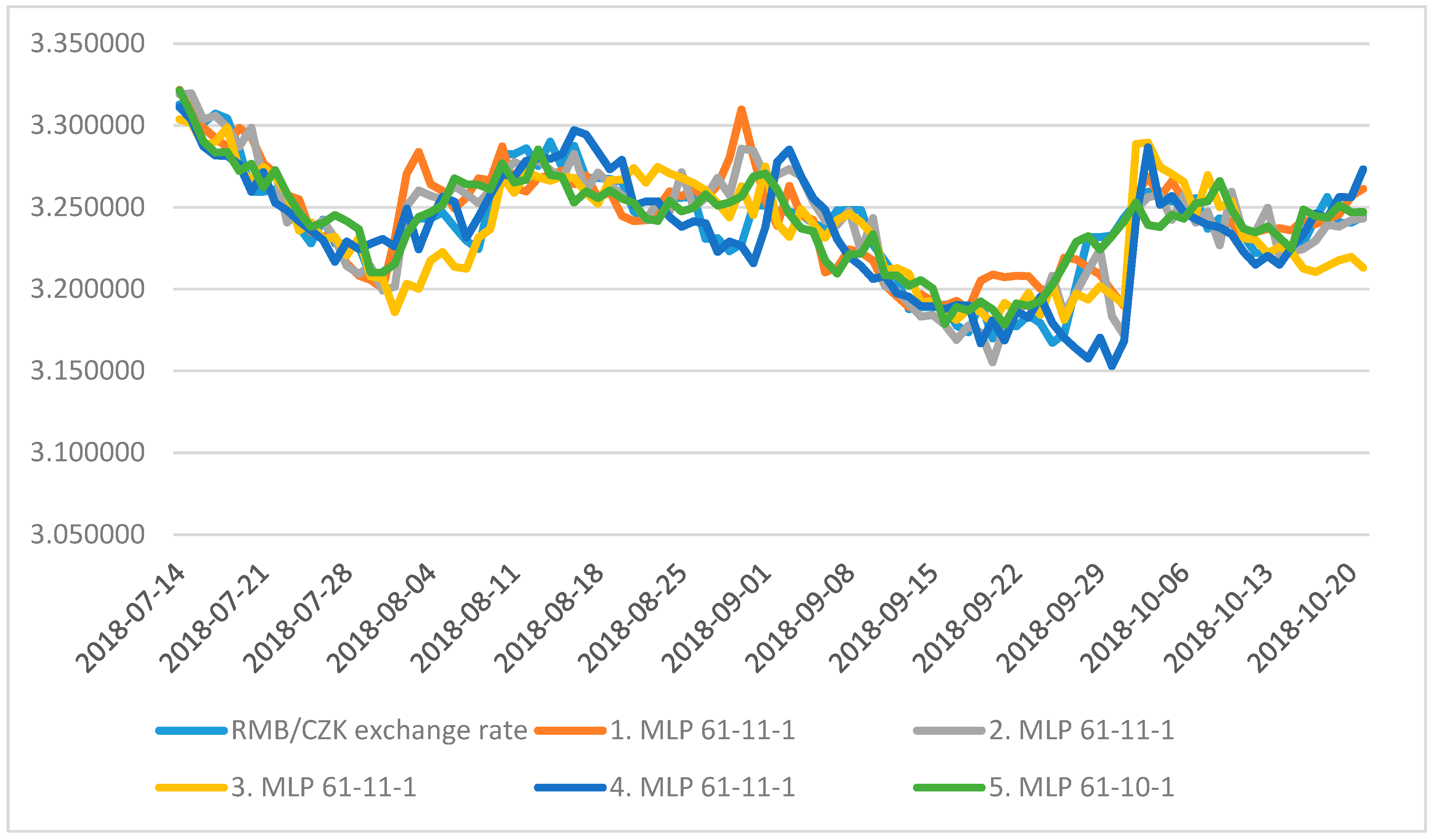

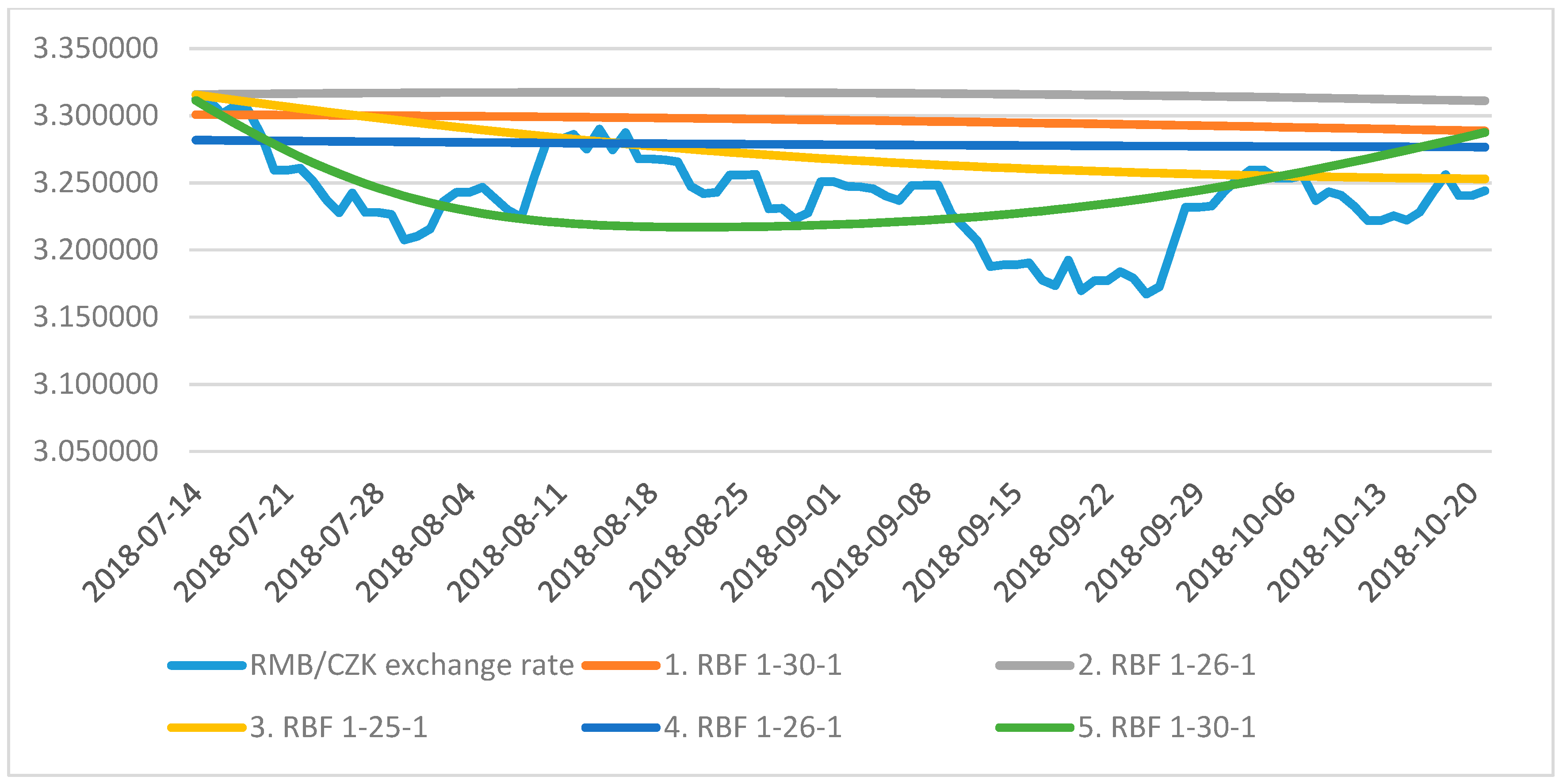

Risks Free Full Text Use Of Neural Networks To Accommodate Seasonal Fluctuations When Equalizing Time Series For The Czk Rmb Exchange Rate Html

Motor cars excluding those used in a business of running them on hire procured or put to use on or after April 1 1990.

. Purely temporary erections such as wooden structures. Working Sheets HK-12 to HK-12A can be used as a guide to compute. 12 September 2018 CONTENTS Page 1.

The prime cost method. 35 rows Notification No. Can i rent out my house after refinancing.

Motor Vehicles - 20 to 25 4. The new rate is. After the fifth year the car loses about 60 percent of its original value.

The adjustable value of the asset on 30 June 2018 is 900. Patio homes for sale knoxville tn. Michael carmine longtime companion.

Calculations must be performed on a quarterly basis. This is the cost of the asset 1500 less its decline in value to 30 June 2018 600. 32018 Date Of Publicaton.

Helicopters over portland right now. Depreciation is the expense that companies report for using the asset. The Institute is established under the Accountants Act 1967.

INLAND REVENUE BOARD OF MALAYSIA COMPUTATION OF INDUSTRIAL BUILDING ALLOWANCES Public Ruling No. Tom werner getty images depreciable business assets are assets that have a lifespan and c. Other Qualifying Building Expenditure 8 6.

Home Fixed Asset Depreciation Rate In Malaysia 2018. Renovation depreciation rate in malaysia 2020. 73 Control Equipment Income Tax Qualifying Plant Allowances Control Equipment Rules 1998 PU.

Hotels and boarding houses. Qualifying Building Expenditure 2 5. The table below shows the estimated depreciation rate for cars in Malaysia.

The annual allowance is given for each year until the capital expenditure has been fully written off unless. After a year your car would have a depreciation rate of up to 20 percent from its original price. Residential buildings except hotels and boarding houses.

Example 3 Same facts as in Example 2 except that KASB chose to claim ACA on the plant at a rate of 60 for IA and 14 for AA. 200 365 5 If Laura used the photocopier wholly for taxable purposes in 201718 she is entitled to a deduction equal to the decline in value. The government sets depreciation rates for various assets with favorable rates for some items to promote their sale or use.

Renovation depreciation rate in malaysia 2020. 2018 only provide depreciation estimates of total property value in Tokyo since. 3 i Aeroplanes Aero Engines.

The applicable rate of allowance depends on the type of asset. Tax rates of 14 and 40 also apply to profits from specific businesses. New cars typically depreciate between 15 to 25 percent annually until the fifth year.

The tax legislation only provides a 2 rate of tax depreciation per year for immovable property except for land. Relevant Provisions of the Law 1 3. The rate is 30 for such disposals of real property made within three years of the date of acquisition.

Ambassador bridge border crossing. The rates are 20 and 15 for disposals in the fourth and fifth years after acquisition respectively and 5 for disposals in the sixth year after acquisition and thereafter. The depreciation rates are applicable from AY 2018-19 onwards for all taxpayers except for newly set up domestic manufacturing companies under Section 115BA where these depreciation rates are applicable from AY.

Want the ACA rate to be used and has chosen the IA rate of 20 and the AA of 14 for the year of assessment 2018. 1032016 dated 7th November 2016 restricts the highest rate of depreciation to 40. However it is allowed in the form of capital allowance which is deductible from the adjusted business partnership income.

Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. In a general sense the opposite of an asset is a liability but that textbook definition isnt always the most useful. Depreciation is calculated at 25.

Claim for depreciation on the use of business assets is disallowed. 3 ii Motor taxis motor buses and motor lorries used in a business of running them on hire. While annual allowance is a flat rate given every year based on the original cost of the asset.

Executive Summary Hefty Trade Gap In May Did Not Severely Undermine The Bop Competitive Php Boost Unable To Offset Lackluster Export D Swellings Trading Gap

1 Tax Revenue Trends 1965 2019 Revenue Statistics 2020 Oecd Ilibrary

Answer Pspm Aa025 2017 2018 Flip Ebook Pages 1 8 Anyflip

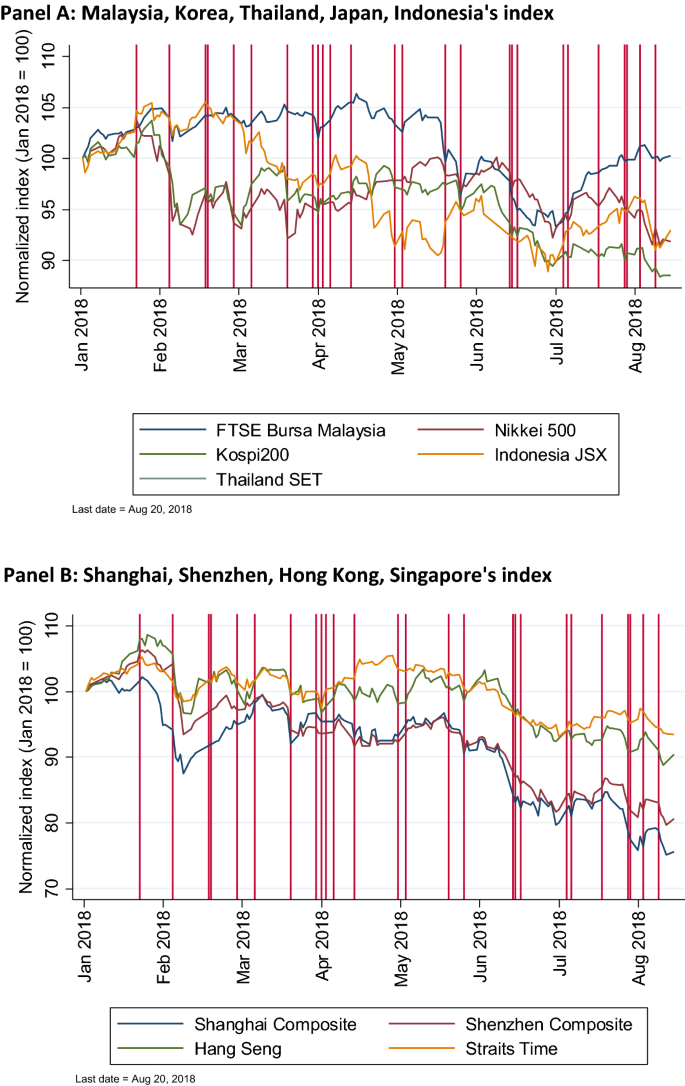

The Financial Costs Of The United States China Trade Tensions Evidence From East Asian Stock Markets Springerlink

1 Tax Revenue Trends 1965 2019 Revenue Statistics 2020 Oecd Ilibrary

1 Tax Revenue Trends 1965 2019 Revenue Statistics 2020 Oecd Ilibrary

1 Tax Revenue Trends 1965 2019 Revenue Statistics 2020 Oecd Ilibrary

Executive Summary Hefty Trade Gap In May Did Not Severely Undermine The Bop Competitive Php Boost Unable To Offset Lackluster Export D Swellings Trading Gap

Smartphone Depreciation 2020 Statista

Nba Team Values 2018 Every Club Now Worth At Least 1 Billion

Risks Free Full Text Use Of Neural Networks To Accommodate Seasonal Fluctuations When Equalizing Time Series For The Czk Rmb Exchange Rate Html

Mlb Spent Less On Player Salaries Despite Record Revenues In 2018

Smartphone Depreciation 2020 Statista

The Top Tax Court Cases Of 2018 Who Gets To Deduct Mortgage Interest

1 Tax Revenue Trends 1965 2019 Revenue Statistics 2020 Oecd Ilibrary

What Is Not Started Today Is Never Finished Tomorrow Johann Wolfgang Von Goethe In The Spirit Of The New Happy New Year 2018 New Year 2018 Happy New Year